05 Feb

New 26% Tax Credit Applies to Stove Purchase Price and Any Related Costs for Installation

The Biomass Thermal Energy Council (BTEC) has been working to implement the Biomass Thermal Utilization (BTU) act for more than a decade - and it’s finally been realized! On December 21st 2020, Congress signed into law a 26% federal tax credit for wood stoves AND wood stove installations complying with these BTU revisions…Meaning more accessibility to clean-burning and modern wood heat for you.

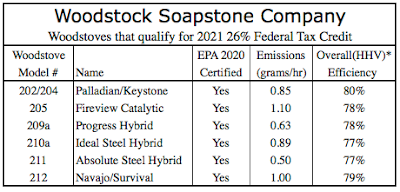

What makes a wood stove eligible for the huge 26% tax credit?

- The stove must meet the 2020 EPA standards

- The stove must have a minimum efficiency of 75% (HHV). More about High Heat Value (HHV) below.

- The stove must be purchased and installed in 2021-2022 (there will be a 22% credit available for 2023)

Lucky for you, ALL Woodstock Soapstone wood stoves are among the elite group that meet these qualifications.

Comparing High Heat Value (HHV) and Low Heat Value (LHV)

Not all wood stove efficiencies are created equal. There are two different metrics for understanding wood stove efficiency: High Heat Value (HHV) and Low Heat Value (LHV). Woodstock Soapstone, like the EPA, uses High Heat Value (HHV) for our efficiency measurements.

High Heat Value (HHV) tests are run using cord wood with approximately 20% moisture content, generating efficiency results similar to what wood stove owner’s experience in their homes.

Low Heat Value (LHV) tests are run as if the wood had zero moisture content, generating results that look better, but aren't reflective of a typical wood stove owner's real world experience.

As an example, a stove tested using HHV may have an overall efficiency of 75% and an artificially higher efficiency of 80% when using the LHV metric.

Just How Far Will a 26% Credit Go?

For a Woodstock Soapstone Progress Hybrid wood stove, the tax credit would realize about a $1,120 credit off of it’s roughly $4,300 retail price. Pair with this an additional 26% tax credit on the installation of the stove itself, and any Woodstock Soapstone wood stove becomes more accessible than it’s ever been.

Progress Hybrid Retail Cost (with Ash Pan): $4,305.00

Federal 26% Stove Tax Credit: -$1,119.30

Cost After Tax Credit: $3,185.70

Plus, the cost of installation qualifies for the same 26% credit. That means 26% on pipe, chimney and labor!

How Do You Apply for the 26% Federal Tax Credit?

Gather your receipts from your stove's purchase and installation, then use IRS form 5695 when you file your taxes. Be sure to include any labor costs properly allocable to the onsite preparation, assembly, or original installation of the residential energy efficient property and for piping or wiring to interconnect such property to the home.

Reminder: qualified biomass fuel property costs are costs for property which uses the burning of biomass fuel to heat a dwelling unit located in the United States and used as a residence by the taxpayer, or to heat water for use in such a dwelling unit, and has a thermal efficiency rating of at least 75% (measured by the higher heating value of the fuel). Biomass fuel means any plant derived fuel available on a renewable or recurring basis.